After Defeat of Swiss Basic Income Proposal, Let’s Name the Real Problems, Find the Real Solution

By THE TRUTH HOUND / Mark Anderson

The June 5 Swiss ballot proposal to introduce a guaranteed basic income—an unconditional allowance for everyone in that neutral Alpine nation—was defeated largely on the basis of the Swiss government’s claim that the idea would “cost too much.”

Reuters added: “Swiss voters rejected by a wide margin . . . a proposal to introduce a guaranteed basic income for everyone living in the wealthy country after an uneasy debate about the future of work at a time of increasing automation. (Emphasis added).”

Yet, the plutocratic Financial Times acknowledged, “The Swiss may have just voted to reject a proposal for a guaranteed minimum income . . . but that hardly means the idea is dead. Pilot projects and feasibility studies are in the works across the developed world, from the Netherlands [and Finland] to California. In Canada, the federal Liberals, along with governments in Ontario, Quebec and Alberta have expressed interest in the concept.”

However, the nearly universal misunderstanding of money is a major obstacle. For too long we’ve allowed a small coterie of bankers and “court economists” to hold the secrets and “tutor” us. So, it’s time for total openness.

First, regarding the claim that the Swiss proposal would’ve been too costly, what’s entirely omitted from the discussion is that the proposal (and similar proposals elsewhere) appear to call for re-distribution of existing money—taking money from certain sectors through taxation and re-allocating it to the people at-large.

The implication is that the money supply is basically static and that re-distributing limited funds would require tough budget decisions—sparking tax hikes and associated spending increases in several areas; hence the claim “costs too much.”

But a successful basic-income plan can and must be based on the creation of new money, or “distributism,” not on reshuffling existing money, which is “re-distributism.” That’s the “state secret” that no one wants to touch.

The issuance of new money needs to happen to overcome the huge “gap” between today’s paltry purchasing power and the massive mountain of debt and the towering totality of prices on all available goods and services. We have full stores and empty wallets. (Ideally and importantly, governments should reclaim their interest-free money-creation rights and forbid private central banks from creating money any longer).

Given such matters, the social credit movement—rarely mentioned in basic-income circles—took root in the early 20th Century via Scottish engineer-author C.H. Douglas and American academic-author Gorham Munson, among others. As it became widely evident that a basic income to supplement employment earnings was (and still is) needed, social credit proponents were quick to explain their concept of introducing new money to bridge that gap and provide a universal allowance with new money.

The amount of money would be equated with production data so empowered consumers could boost overall demand and liquidate inventories, which keep factory orders flowing properly. Yet the amount would not exceed the quantity of available goods, thereby avoiding a type of price inflation.

Our price increases mainly come from the cost-push process, where excessive taxes, interest charges and operational costs are pushed on to the end consumer—meaning that “printing too much money” is not the inflation-causing bogeyman that so many fright artists claim it is.

This is especially important to point out, given that the world largely operates on an all-borrowed money supply, wherein new loans are constantly taken out to pay off old ones, public and private—a vicious cycle which stacks debts ever higher and depletes purchasing power via “interest drain.” Price increases and money shortages have become institutionalized.

As for the automation paradox, social creditors and other visionaries for years have spoken of the “wage of the machine,” meaning that we must cancel the rule that income can only come from jobs via human labor.

Instead, under social credit, a basic income would come in the form of a regular dividend paid to the population at-large calculated, as noted above, on production output—regardless of whether that production required human labor or whether it was largely or completely automated. That critical distinction means increased leisure time along with better income, which makes automation a friend, not a foe.

Other social credit components would stabilize and lower prices. Thus, increased leisure, much more spending power and lower prices are all within reach, which could foster a renaissance in human thought and action because the unforgiving yoke of the obligatory “work state” would be lifted off our backs. See www.Socred.org

Put another way: We were born to do more than just go to work, pay bills and die.

Totally agree.

Mark has identified the weakness of the various current proposals for a guaranteed basic income, such as that recently rejected by voters in Switzerland. The problem is that such programs are simply not financially viable because they are essentially demands for a massive redistribution of incomes via taxation. This suggests implicitly that the price system is balanced and it is upon this false assumption that such programs fail and have not been implemented in any general way.

As Mark has pointed out, the Social Credit approach proceeds from the proven fact that the price-system is not self-liquidating, i.e., that it produces financial costs and prices at an increasing rate of flow relative to the rate that it distributes effective consumer income. As the economy modernizes and non-labour costs continue to comprise an ever larger component of price relative to income generating costs, i.e., wages, salaries and dividends, the deficiency of effective consumer buying power become increasingly larger.

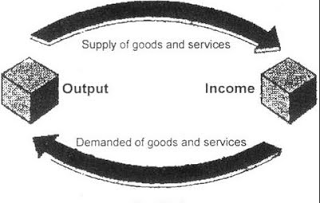

Obviously, the economy could not function without some intervening factor. That factor is primarily expanding financial debt whereby the banking system creates vast and expanding volumes of money as credit, i.e., debt, to allow the goods of industry to be purchased. Of course when they are purchased the consumers depart with their money and business returns it to the bank to settle its original production loan, and the bank cancels this money out of existence–just as it created in the first place by issuing it as a loan. The critical point to note is that this does not end the matter. Consumers may have access to the goods but they are now indebted to the banks and must repay these loans over a period of years and the repayments can only be made by the inflationary process of extracting the required money from future cycles of production. For the privilege of living today we are forced to mortgage our future. This make no realistic sense because the physical costs of production are met as the production occurs and are fully met when goods are completed and ready for market. This reveals a serious cost-accountancy error in the existing financial price-system which is revealed to be non- self-liquidating or incapable of liquidating the costs of production without drawing increasingly on future incomes. What is required is an external source of income that cancels financial costs without being issued as debt and creating new costs as current financial practice wrongly requires.

Thus what is required is that the monopoly of credit creation held by the banks must be broken by an extraneous injection of consumer purchasing-power that is not issued as debt but is effective consumer buying power capable of finally liquidating the costs of production without leaving a trail of debt to be worked out of the future. The deficiency of purchasing-power cannot be solved by any re-distribution of existing incomes. What is required is a distribution of additional purchasing-power which allows consumer access to produced goods, permits business to recover it costs from sales–and does so without any residual debt in the community. The banks are presently creating new money to function as purchasing power but the great injustice is that they claim ownership of this money which they issue to monetize the community’s wealth–wealth which they do not create! The money which they create belongs to the community and should be credited to the community. In effect under current arrangements the banks have in effect appropriated the communal credit–which must be restored to the community. How is this best to be accomplished?

The appropriate manner by which to effect this restoration is to have prepared a National Credit Account, being an actuarially determined estimate of the “real credit” of the nation, i.e., the ability to deliver goods and services as, when and where required or desired. This would include all natural and human resources which might be available for production and which might result in prices if so employed. This NCA would always be growing as the value of new capital assets was credited to it. Money should be drawn from this NCA to finance: (1) the payment of National Consumer Dividends to all citizens as an inalienable inheritance and (2) payments to retailers at point of sale, enabling them to institute Compensated Retail Prices, i.e., to reduce the price of their products by a universal discount factor determined by the ratio of national consumption to national production in any designated costing cycle. The monopoly of the banks to create credit must be broken, the ownership of credit must be restored to the community, the price-system must be balanced and prices must be reduced so realistically to reflect the enormous increases in real efficiency which the modern technological economy is regularly achieving. We can thus be freed from the tyranny of the perpetual Work State and enjoy increasing leisure in the context of economic security. Because nations would no longer be under duress to export more goods than they export in a futile and increasingly competitive effort to compensate their internal deficiencies of purchasing-power, the major cause of war would be eliminated.